does the irs forgive back taxes after 10 years

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. Tax debt can be scary.

Back Taxes Legal Ways To End Your Problems With The Irs Debt Com

As a general rule of.

. Yes indeed the length of time the IRS is allowed to collect a tax debt is generally limited to ten years according to the statute of. You may feel overwhelmed and uncertain about what to do. In general the Internal Revenue Service has 10 years to collect unpaid tax debt.

Does The Irs Forgive Tax Debt After 10 Years. After this 10-year period or statute of limitations has expired the IRS can. Does IRS forgive debt after 10 years.

After this 10-year period or statute of limitations has expired the IRS. Continue reading to learn more on tax debt forgiveness after ten years. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

Yes indeed the length of time the IRS is allowed to collect a tax debt is generally limited to ten years according to the statute of limitations on. It is not a matter of the IRS forgiving taxes after 10 years. How far back can the IRS collect unpaid taxes.

After that the debt is wiped clean from its. Does Irs Forgive Tax Debt After 10 Years. The IRS has 10 years to collect taxes that are not paid.

By law the IRS has 10 years to collect a tax after assessing it which means entering the tax. Does the IRS Forgive Tax Debt After 10 Years. 10 years Generally under IRC 6502 the IRS will have 10 years to collect a.

Does the IRS forgive back taxes after 10 years. After this 10-year period or. The debt is wiped from the books by the IRS.

This means the IRS should forgive tax debt after 10 years. Does IRS tax debt go away after 10 years. The statute of limitations that the IRS has to collect a tax debt is typically ten years.

However there are a. The IRS generally has 10 years to collect on a tax debt before it expires. After that the debt is wiped clean from its books and the IRS writes.

This is called the 10 Year Statute of Limitations. This means that the IRS can attempt to collect your unpaid taxes for up to ten years. Answer 1 of 8.

The day the tax debt expires is often referred to as the. Put simply the statute of limitations on federal tax debt is 10 years from the date of tax assessment. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

Its not exactly forgiveness but similar. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. September 21 2022 Jessie.

Can The Irs Collect After 10 Years Fortress Tax Relief

The Tax Help Guide Ultimate Resource For Tax Help Questions

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Help With Irs Debt 11 Ways To Negotiate Settle Tax Debt

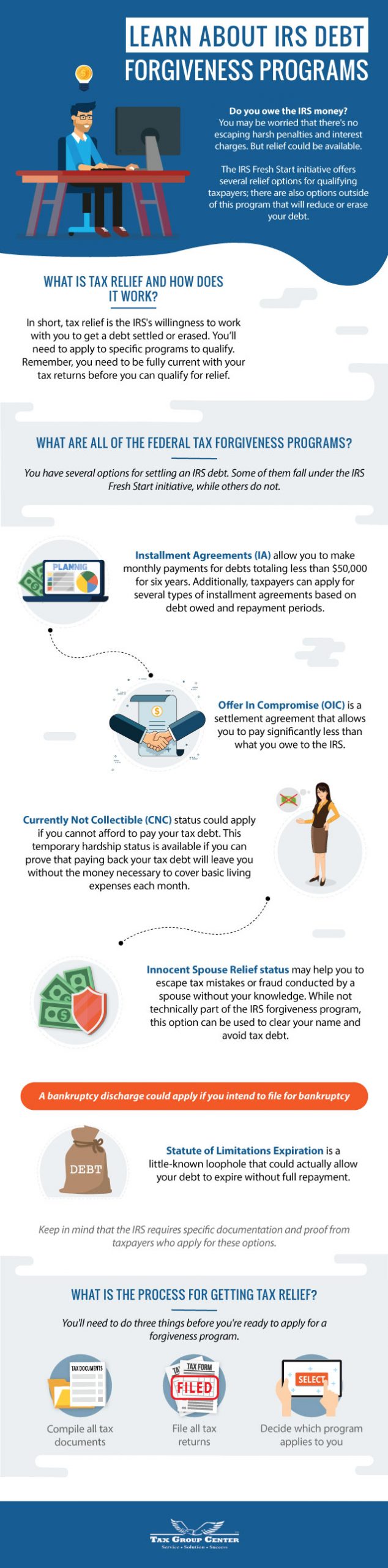

Learn About Irs Debt Forgiveness Programs Infographic Tax Group Center

How Far Back Can The Irs Collect Unfiled Taxes

Rich People Are Getting Away With Not Paying Their Taxes The Atlantic

What To Do If You Owe The Irs And Can T Pay

/cloudfront-us-east-1.images.arcpublishing.com/gray/MM77HGSL3FFE5GT4HHPKHD3P6I.jpg)

Irs To Refund Penalties For Millions Of Taxpayers Who Filed Late Amid Pandemic

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Irs Fails To Pursue High Income Nonfilers Who Owe 46 Billion In Back Taxes Watchdog Says

California Tax Debt Forgiveness Will The Ca Ftb Really Forgive Tax Debt Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Irs Fresh Start Program Services Lifeback Tax

Does The Irs Forgive Tax Debt After 10 Years

Irs Statue Of Limitations Precision Tax Relief

Unfiled Tax Returns Top Questions Answered

Claim A Missing Previous Tax Refund Or Check From The Irs

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

Does The Irs Forgive Tax Debt After 10 Years Sort Of Tax Attorney Explains Expiring Tax Debts Youtube